You're conducting a business transaction

Selling your house to a family member or friend can be a great way to get your property off the market in a short time and comes with specific challenges.

Imagine you're getting ready to retire and want to downsize to a smaller house somewhere in a warmer climate. The only issue is buyer demand in the housing market is low, and many homes are on the market for a long time before they sell. Plus, you're worried buyer leverage could reduce the potential sale price, leaving you little money to spend on your new house. After paying off your first mortgage, you're not ready to get another one, and you don't want to put your retirement plans on hold.

Then, you remember your nephew who recently got married and is in search of a home to start his family. You know he has a good job and might be interested, and you can simplify the process of selling your house if he wants it. It's a win-win situation, as you don't have to find a buyer and can give your nephew a deal.

Before you get ready to hand him the keys to the property, consider the following:

There are alternative financing options

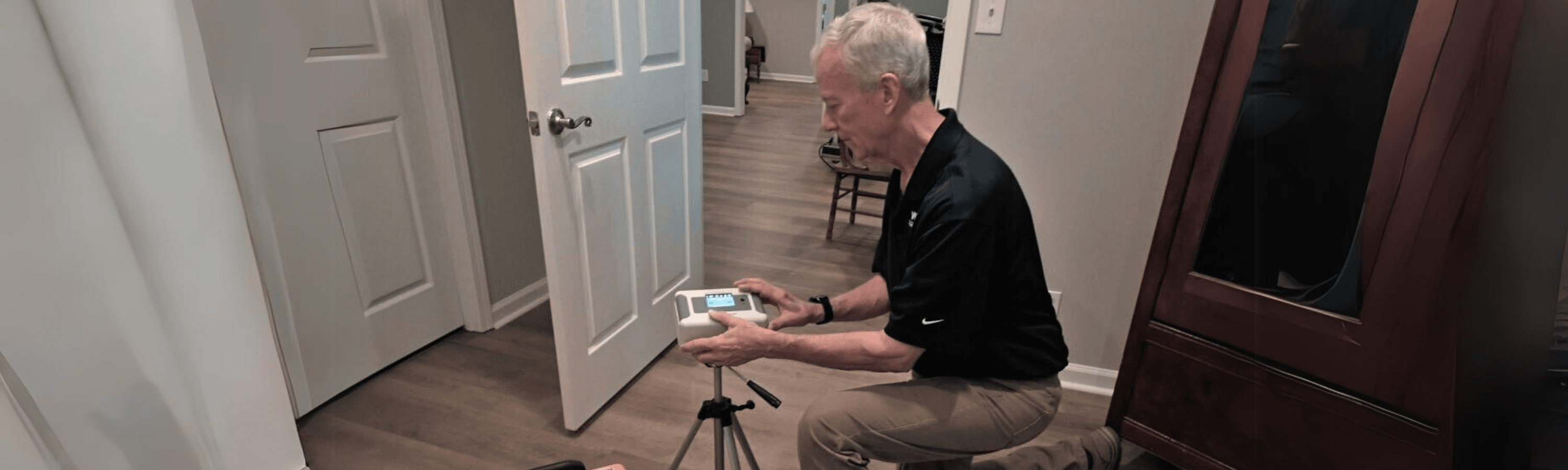

Regardless of whom you're selling your house to, you're still involved in a business endeavor. This means all agreements need to be in writing. While you may trust your friends and family, both parties need to be protected. For detailed advice on which legal documents are appropriate for the transaction, consult a real estate attorney.Also, there are some steps of the traditional home selling process that you may not want to skip if you want to give your loved one the appropriate value for the investment. Get the home appraised to ensure you're selling for the right price, including any discount you're offering. Order a building inspection so the buyer can have a clear idea of any repairs that need to be made and to determine whether you want to address some of those issues yourself.

You can add the buyer to your title

Given the trust you have between family and friends, you may not need to request the buyer get a mortgage to pay for the house. This helps you eliminate some steps in the process and finish the transaction in less time.Instead, you can conduct what is known as an owner-financed sale. Rather than paying a mortgage company each month, the buyer can pay you directly. You'll have to determine your own payments based on your needs and may want to include a clause in your agreement that says you repossess the house if the buyer defaults.

If you don't charge interest on the loan, beware of imputed interest, which is when the IRS considers the interest you're not charging as income to you. The agency has a monthly publication that details the lowest rate you can charge as a lender without triggering any issues.

If you use a quitclaim deed, your friend or family member becomes listed on the property's title. You can receive payments directly, or the buyer can take out a second mortgage and pay you. With the latter option, you must consider your loved one's ability to repay the loan. Given that you're listed on the title, the debt is also considered your responsibility.

Whichever route you choose, remember the process becomes more difficult if you still owe on your mortgage. Lenders typically don't approve short sales to buyers who have a relationship with the homeowners.

Get the Latest Insights!

Sign up to stay up to date with latest tips, trends and updates from WIN.