A good credit score is vital for people looking to buy a house, but what should you do if your credit is too low or hasn't been established long enough? If your credit score is good enough, it can help you secure a lower interest rate on your mortgage.

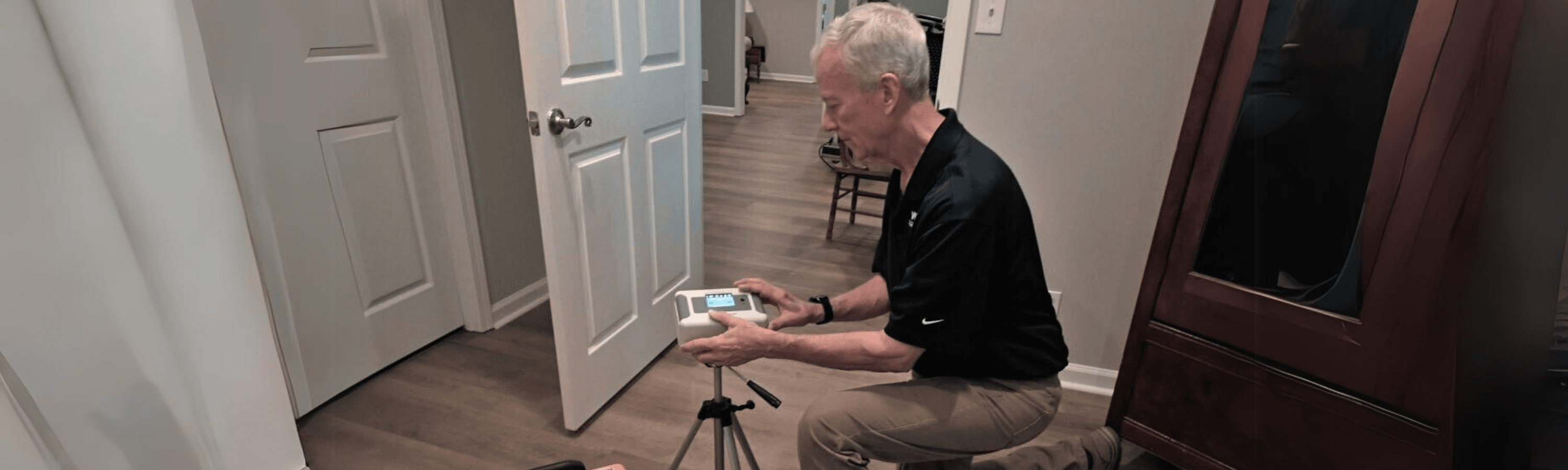

Hello, and welcome to another WIN Home Inspection video blog!

Did you know not all credit is bad? Student loans and other forms of good debt is an investment that creates value. You should ideally have more good credit obligations than bad ones.

You'll also want to avoid any big purchases, such as buying a new car because banks don't like to see sudden changes in your credit right before purchasing a home.

Thank you for tuning and learning how to improve your credit score and secure the lowest interest rate when you apply for a home mortgage.

Get the Latest Insights!

Sign up to stay up to date with latest tips, trends and updates from WIN.