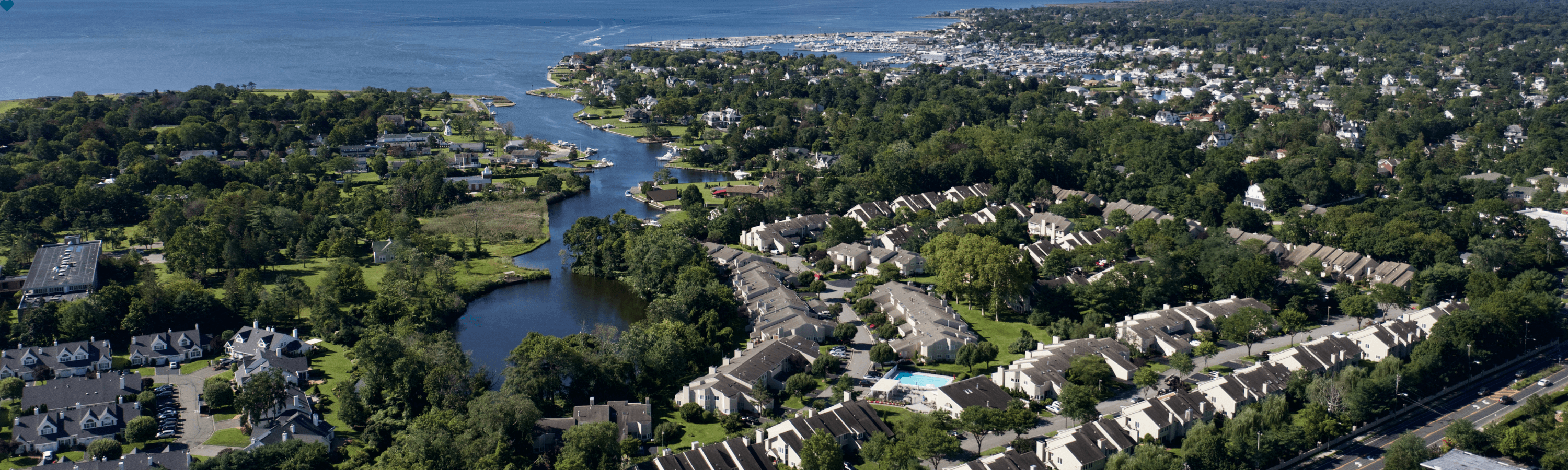

A property owner who wants to optimize the value of his or her residence may consider numerous home repairs. With an in-depth house inspection, this person can learn about a residence and develop a game plan to complete home maintenance in a timely fashion.

Additionally, the U.S. economy has made it more important for many homeowners to devote significant resources to property improvements. Because refinancing a house can often help an owner save money over an extended period of time, he or she may benefit by performing immediate repairs.

Boosting a home's value

Credit.com contributor Scott Sheldon points out that home repairs can significantly affect a house's value. If a property owner invests in improvement projects, however, he or she must understand the difference between substantial and cosmetic maintenance.

According to Sheldon, cosmetic repairs do not affect the value of a house. For example, painting a residence's walls or redecorating different rooms may make a living space feel more like a home, but these modifications might not help boost a house's value.

Meanwhile, adding a bathroom or bedroom could help a property owner increase a house's value. The cost of constructing a new room can be prohibitive, and property owners should conduct a comprehensive analysis to determine whether it is worthwhile to make drastic changes to their residences.

The benefits of refinancing immediately

A property owner who intends to keep a residence may profit if he or she refinances sooner rather than later. Because the economy continues to recover from the downturn of the late 2000s, interest rates may increase soon, which could cost homeowners thousands of dollars down the line.

Instead, those who speak with refinancing experts can learn about the interest rates that are currently available from lenders. By doing the necessary research, a property owner could refinance a mortgage and noticeably reduce his or her annual bills.

While many property owners are reaping the rewards of refinancing, those who wait too long may miss out on numerous opportunities to save money. To avoid such issues, these people should evaluate their options soon.

Optimizing the value of a home

Before refinancing, a homeowner should complete a property inspection to evaluate the quality of his or her house. Reviewing a residence's interior and exterior could help a property owner determine where maintenance is necessary.

A homeowner could also create a preliminary budget to study how much it will cost to complete various repairs. Some projects could prove to be more expensive than others, and property owners should prioritize their tasks as well.

With a comprehensive approach, a property owner can get a better idea about the condition of his or her home and decide if specific modifications are vital. This evaluation may also help with the refinancing process, as property owners can submit their materials to lenders and determine the best way to invest the savings.

Dedicating resources to home repairs

Depending on the interest rates that are available and the condition of a house, refinancing a mortgage may help property owners save thousands of dollars. Property owners can gradually invest the savings in their houses as well, which could have major effects.

A step-by-step approach to home repairs is typically valuable, enabling property owners to improve their houses. These people can also avoid becoming overwhelmed by projects, and by spending only a little bit at a time, homeowners could have extra funds available should emergencies arise.

Staying up to date on home repairs is crucial, and refinancing could provide substantial funds to those who want to complete property improvement projects.

Get the Latest Insights!

Sign up to stay up to date with latest tips, trends and updates from WIN.