We are inching closer and closer to April 15, and it is important that homeowners are aware of every possible tax credit and deduction they can get for their homes. This recent article outlines many significant deductions that homeowners may not know about, from a mortgage interest deduction to a deduction for renting out rooms to tourists. But what about deductions for making changes to your home? If you have recently made renovations that improve the quality and/or value of your home, are you eligible for a deduction? Beyond individual home improvements, some state and local governments offer tax incentives for broader housing development projects. For instance, converting underutilized office spaces into residential units is encouraged through tax incentives for office-to-residential conversions.

You will probably not be surprised to learn that the answer to this question is more complicated than yes or no. Unfortunately, taxes are never that simple. Whether you qualify for a tax deduction on home improvements depends on the type of improvement you have made - and whether it can be defined as an improvement at all.

What qualifies as a home improvement?

There is a big difference between a home improvement and a home repair. A repair means you have fixed something broken, restoring the home to its original state. An improvement, on the other hand, means you have taken action to make the home better than it was when you bought it. Unlike a home repair, Trulia explained, a home improvement has the potential to raise the home's property value. Thus, repairs are almost never tax deductible.

One major exception to that rule, however, are repairs made after a natural disaster. The IRS' Casualty, Disaster, and Theft Losses rule qualifies properties that are damaged or destroyed as a result of tornadoes, fires, earthquakes, hurricanes, floods or volcanic eruptions.

Capital improvements and tax deductions

Trulia explained that most home improvements you make that boost your home's value will not qualify you for a tax deduction the year the changes are made, but you may be able to claim them when you decide to sell your home. These value-boosting improvements are called capital improvements - permanent changes that increase the quality of the home in some way.

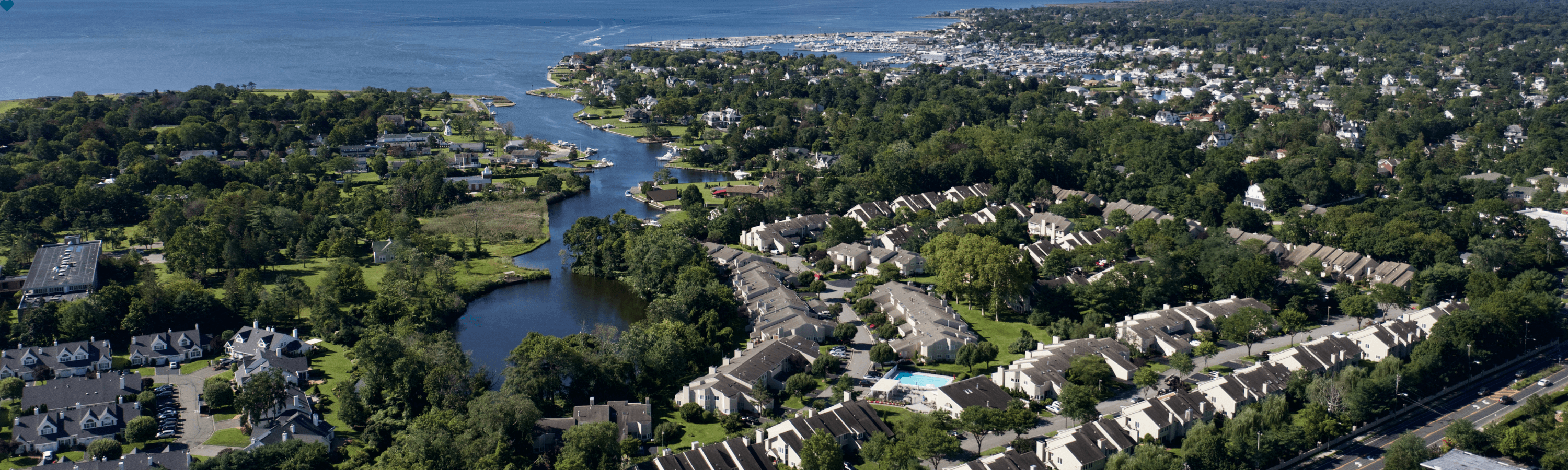

Turbo Tax provided a few examples of capital improvements, explaining that they could be something as large as a new swimming pool or a new roof or as small as new storm windows or a new water heater. As long as they are permanent, they will probably count. It is important to keep track of everything you pay for these improvements over the years because when you sell your home you can factor those costs into the base price of the house. When your house sells, you can then use that newly calculated base price to determine if you made a profit. If that profit exceeds the amount of tax-free home sale profits currently allowed ($250,000 for a single person and $500,000 for a married couple filing jointly), then you will qualify for a deduction. So even if you are making an improvement that you do not think will qualify for a tax deduction right away, make sure to save those records and receipts. They may come in handy later on.

There are, however, a few changes you can make to your home that can make a more immediate difference for your taxes.

Home improvements that are tax deductible

There are a few improvements you can make that you'll be able to claim on your taxes without having to sell your home.

According to Credit.com, the Nonbusiness Energy Property Tax Credit will give tax deductions to homeowners who have installed new, energy-efficient water heating and air conditioning systems or more energy-efficient doors, windows and insulation. The Residential Energy Efficiency Property Credit also offers deductions for going green. According to the IRS, those who install qualified solar electric systems, solar water heaters, fuel cell property, wind energy property and/or geothermal heat pumps are qualified for a tax credit of 30 percent of the costs of the new systems.

Environmentally friendly improvements are not the only way to earn a tax break, though. If you have a home office, Trulia said that any improvements (or even repairs) made to the space may qualify you for a deduction. According to legal advisory company NOLO, if you make improvements to an area of your home that is used solely for work, you can claim 100 percent of the improvement costs as a deduction.

The IRS has many rules regarding exactly what qualifies for this type of deduction, so check out the information it provides regarding the Business Use of Your Home to find out if you make the cut.

Any home improvements made to help someone with a disability will also qualify you for a tax deduction. For example, if someone in your home is in a wheelchair and you install ramps throughout the property, you get a deduction. These types of improvements can be claimed as a medical expense. Trulia explained that the amount you are able to deduct varies depending on whether the improvement increased your home's value. If it did not increase the value, you can claim the entire cost of the improvements as a medical expense. If your home's value did increase as a result of the improvements, you may only claim the difference between the new and old value.

Take the time - it's worth it

Taxes are never much fun to deal with, but knowing what you qualify for will at least ensure you get the rewards you deserve. You may not want to deal with all that extra reading and paperwork, but taking the time to educate yourself will probably pay off in the long run. Whether or not you have recently made improvements to your home, there are probably at least a few tax breaks for homeowners out there that you do not know about. Do as much research as you can, and if you are feeling overwhelmed consider consulting an expert. You may even qualify for free assistance. According to the Duluth News Tribune, the IRS offers free software for those who earn less than $62,000 a year.

Get the Latest Insights!

Sign up to stay up to date with latest tips, trends and updates from WIN.