As professional home inspectors, we've witnessed a concerning trend during a seller's market - an increasing number of home buyers are foregoing inspections in their eagerness to secure a property. This decision, while understandable in a competitive market, often leads to unforeseen and sometimes costly issues down the line.

The 2020 real estate shutdown led to an increase in buyers making offers without home inspections, sometimes even without seeing the property beyond photos or videos. This raised legal concerns around inaccurate representation once the true condition of the property was revealed. Real estate associations require forms for buyers to acknowledge the risks of waiving inspections. The success of subsequent lawsuits remains uncertain.

Homeowners who skip their inspections tend to discover undisclosed or inaccurately disclosed problems after moving in instead of before, when they could’ve lowered their purchase price. These homeowners often seek a home inspection as a first step in potential legal actions against various parties involved in the sale – a costly alternative to simply getting a home inspection from the start. These inspections reveal issues that are now the responsibility of the new homeowners, as negotiation with the seller post-closing is no longer possible. Typically, we are hesitant to enter post-close disputes and instead prefer to conduct inspections pre-close to help buyers make informed decisions.

As home inspectors, we encounter various serious problems, including faulty electrical work, damaged foundations and leaky roofs needing full and costly replacements. Basements with water damage, ranging from puddles to severe mold growth, are frequently discovered in Post-Close Inspections. In many cases, these issues were not disclosed or were inaccurately represented in seller disclosures.

These examples underscore the crucial role of home inspections in the buying process. While waiving an inspection might facilitate a purchase in a competitive market, it can lead to significant, unforeseen problems. Ideally, inspections should be conducted as part of the sales agreement to enable negotiations on any discovered issues.

In some states, home buyers can opt for a Home Buyer or Verbal Consultation, which is typically cheaper and faster than a standard Full Home Inspection since it doesn’t include a written report. However, this option is not available to all home buyers as some states require a written report by law.

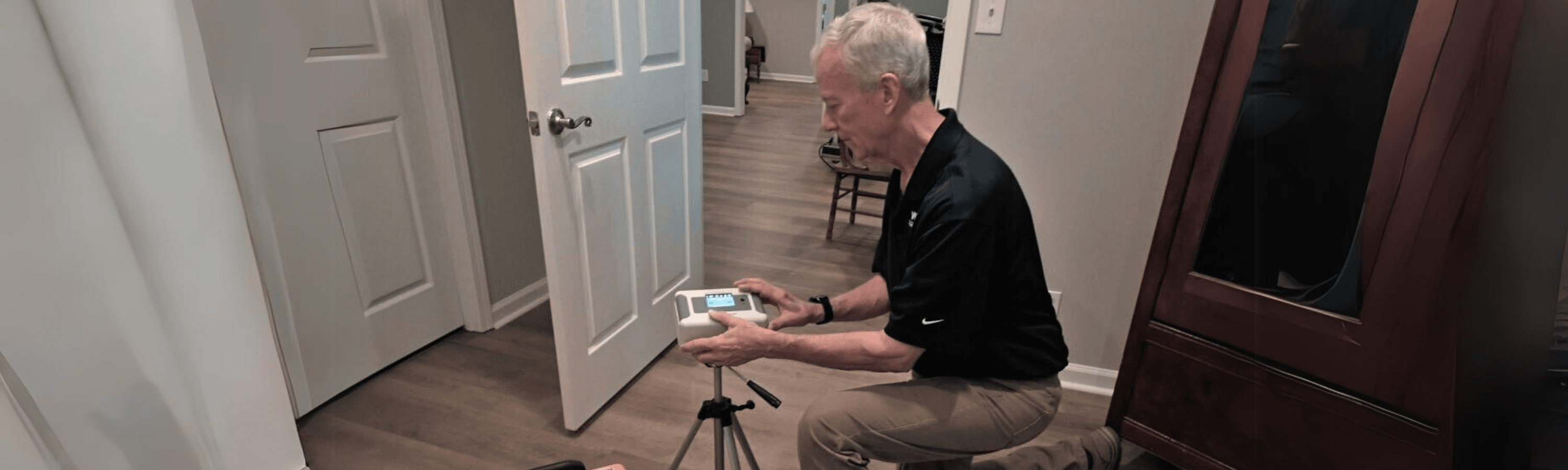

If you waived your initial home inspection when buying your home, it is still important to get a Post-Close Inspection. While conducting an inspection after taking ownership doesn’t give room for negotiation or backing out of the purchase, it can guide new homeowners on where to prioritize repairs and budget maintenance funds.

Finally, certain types of loans, such as USDA, FHA, or VA loans, have mandatory inspection requirements that cannot be waived. It’s important to understand your home loan’s requirements before waiving your home inspection. For homes with wells, water testing is still required under these loans, and VA loans specifically require a WDO/WDI (Pest) Inspection.

In the excitement and haste of a seller's market, waiving a home inspection is a tempting shortcut. However, as evidenced by the issues our clients have faced, this decision can lead to significant challenges. Whether before or after purchase, a thorough home inspection is a critical step in understanding the true condition of a property and avoiding costly surprises. As home inspectors, our goal is to provide buyers with the information they need to make confident and informed decisions about their potential new homes.

Get the Latest Insights!

Sign up to stay up to date with latest tips, trends and updates from WIN.