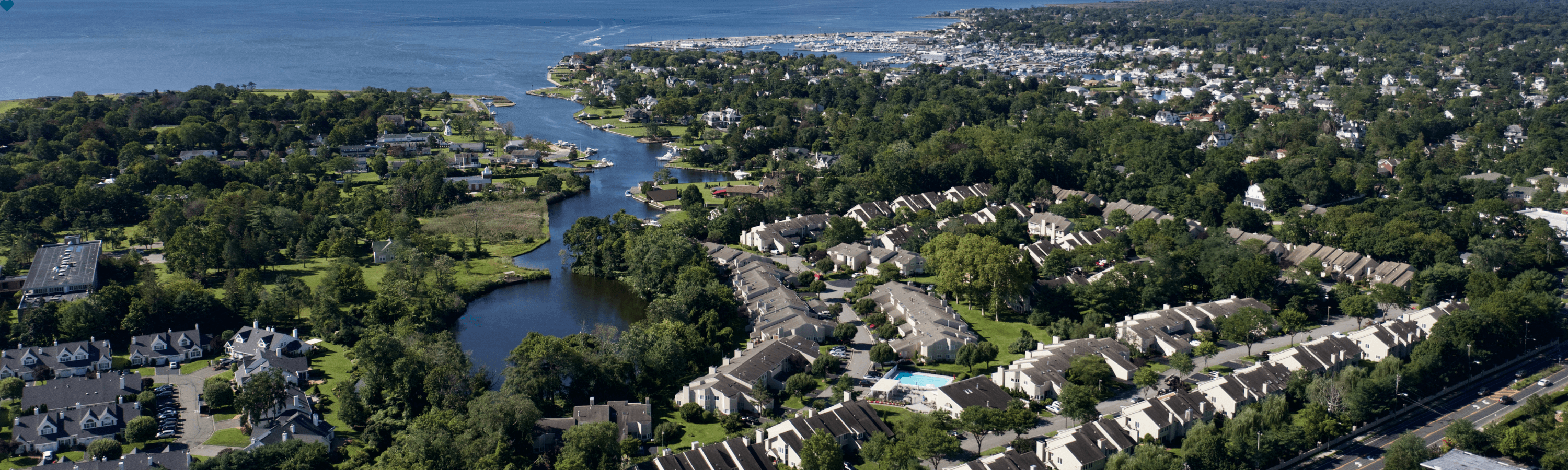

There are many options on the housing market if you're looking for a house that requires a little work but can offer noticeable discounts, including bank-owned, or real-estate-owned, properties.

Homes go through several stages after the owners default on their mortgages. The first part is foreclosure, which gives the borrowers a chance to pay what they owe and keep their properties. If the owners cannot come up with the necessary funds, the homes enter the auction stage. During this time, the lenders that have liens on the properties put the houses up for auction. If no one decides to buy the homes at auction, the lenders repossess the properties.

As such, REO homes have gone through each stage of the foreclosure process. Considering the homeowners are no longer in the picture, the steps involved in buying one of these houses are different than a normal home sale.

Bank-owned properties can be sold as-is

The foreclosure process can take some time, during which the homeowners may not be in the home. Consequently, the house can be vacant and neglected for some time. In many cases, REO homes are solid as-is, which means the bank will not make any repairs to the property as a condition of the sale.

To get a full understanding of what issues a property has before you close on it, you'll need to schedule a building inspection. Although the bank won't foot the bill for repairs, you can ensure there aren't any hidden surprises that you can't afford to fix yourself once the property is in your hands.

The inspection report may reveal you need to do some serious work to get the property where you want and to meet safety standards. If you're up for handling a home renovation, you can go in with an estimate of how long the work will take and how much it will cost.

You'll need a title search

Bank-owned houses may have outstanding taxes and other liens. These debts can create issues with homes' titles and come from contractors and other sources.

One disadvantage of these liens is they can drive up the sale price. Plus, you may be required to pay off the remaining balance although you're not the one who owes these debts. In many cases, the lenders that own the property will clear any liens on the home, but this isn't guaranteed.

Run a title search to determine if anyone else can lay claim to the property. This is a step you should also include when buying any other kind of property.

Negotiations can be tough

REO homes are popular for many home buyers who want to get a nice fixer-upper for an affordable price. They can offer sizeable discounts because lenders want to get rid of the properties quickly.

However, when lenders repossess homes, they risk taking a large loss on the money they loaned to the homeowners. As such, they may negotiate more aggressively than regular home sellers. They want to recoup as much of their funds as possible, so a lowball offer may not be received well.

Two factors can work to your advantage during the negotiation process: the prices of comparable properties in the area and the results of the home inspection. If similar houses are selling for less money, you can argue for more of a discount. Your real estate agent can help you find this information. Lenders may not be willing pay for repairs, but they could drop the price if the inspection reveals a plethora of costly issues.

Get the Latest Insights!

Sign up to stay up to date with latest tips, trends and updates from WIN.