For many first-time home buyers, a somewhat daunting process can be made less intimidating by breaking things down in the form of a checklist. From the preliminary search to the home inspection, the more organized and prepared you are for each step, the easier it will be to navigate them smoothly.

Rather than get bogged down and stressed out in the many nuances and details of the process as a whole, you may find it simpler to break things down into separate, more manageable undertakings. Here's a step-by-step breakdown of the essentials, best approached incrementally:

- Credit and approval. You'll need to check your credit score before even beginning to look at houses, since this will be one of the primary determinants of what size loan - if any - you're eligible to receive. Once you've got an idea of your creditworthiness and made sure your finances are in order, then you can speak to a lender about becoming pre-approved for a mortgage. Doing so will help set your budget, and in turn, dictate the neighborhoods and types of homes you look at.

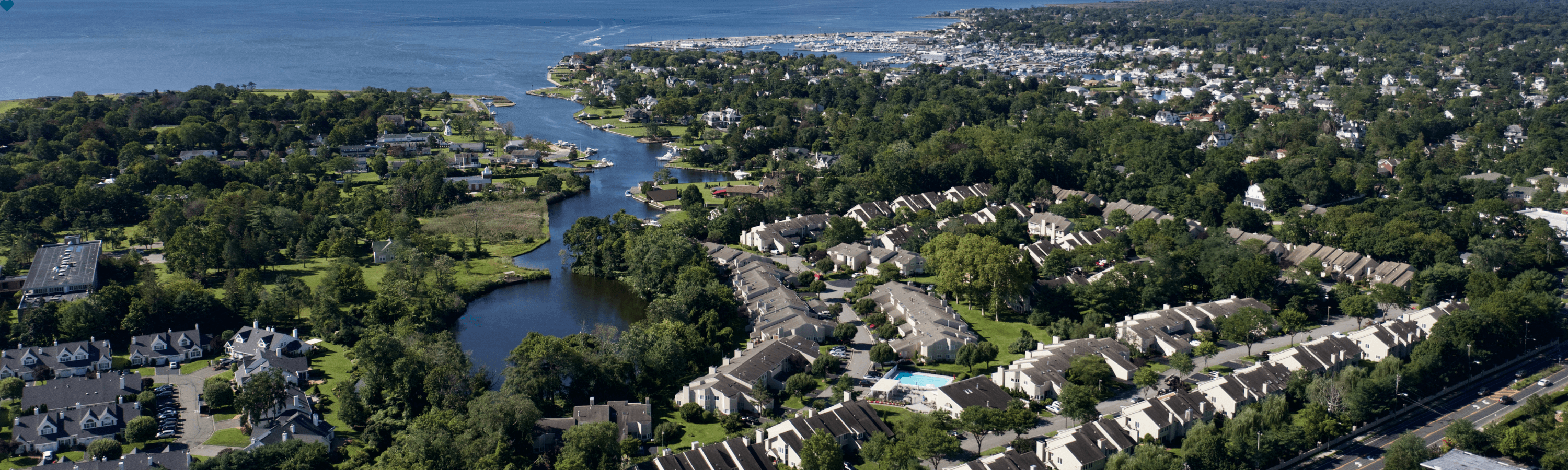

- The hunt. Once approved, you'll likely want to hire a real estate agent or broker to help you navigate the shopping process. It can be a lengthy undertaking, depending on where you're searching, what you can afford and how specific you are in your preferences. If you're dead-set on a four-bedroom home in the city with a fence and a garage, within walking distance from a public transportation route, your search may take longer - but that's what the real estate professionals are there to help with.

- Making an offer. In many cases, sellers will intentionally price their homes above market value, which makes your consultations with an agent who knows the property that much more valuable. If they can provide you with some context - in the form of comparable sales - you can gauge what sort of offer needs to be made and go back and forth. Once your offer is accepted, you'll make a deposit that affirms your commitment and level of seriousness as a buyer.

- The inspection process. Not to be overlooked, the home inspection is a crucial step before closing on your new home - one that helps ensure peace of mind. In the event that the inspection uncovers structural or otherwise previously unforeseen issues, that may trigger the activation of a contingency built into your contract. It's almost always preferable to work things out with the seller, even if it extends the process by a few days or weeks, than to discover an issue after closing that requires extra time and effort to fix.

Share This Infographic On Your Site or Blog

Get the Latest Insights!

Sign up to stay up to date with latest tips, trends and updates from WIN.